See the events that created the Virginia529 of today.

Virginia’s Savings Success Story Begins

Virginia General Assembly passes legislation enabling creation of prepaid tuition savings plan in Virginia.

Virginia Higher Education Tuition Trust Fund (HETTF) forms and starts developing a prepaid program.

16,000 Sales in Year One

Virginia Prepaid Education Program (VPEP) opens for enrollment and sells more than 16,000 contracts in its first year.

Section 529 Added to Internal Revenue Code

Congress passes Section 529 of the Internal Revenue Code, clarifying the federal income tax status of state college savings programs, creating tax advantages for saving in a 529 account and authorizing both prepaid and savings programs.

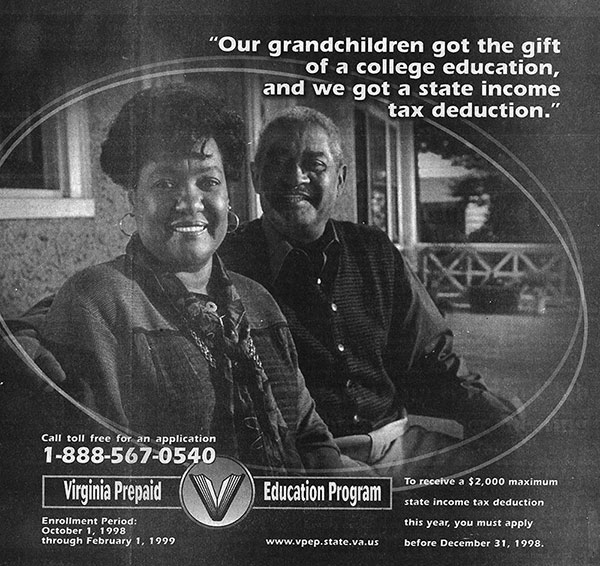

$2,000 State Tax Deduction

Virginia General Assembly enacts up to $2,000/year state income tax deduction for contributions to Virginia Higher Education Tuition Trust Fund accounts.

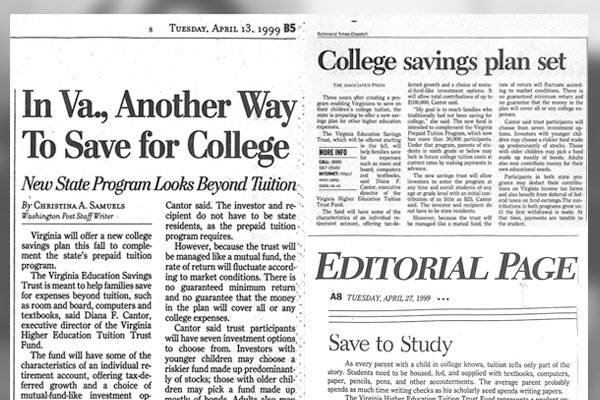

Expanding Mission

Virginia General Assembly authorizes creation of savings programs.

VEST Unveiled

Virginia Education Savings Trust (VEST) launches as one of the first direct-sold college savings programs in the country.

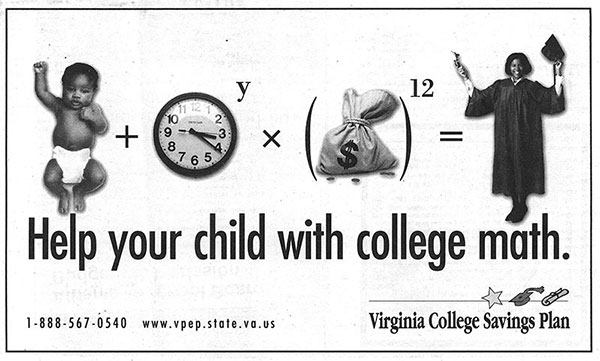

New Name

Agency name changes to the Virginia College Savings Plan, now commonly known as Virginia529.

Congress makes qualified distributions from college savings programs tax-free; previously they were taxed upon distribution to the beneficiary (student).

CollegeAmerica Kicks Off

Virginia529 joins with the American Funds companies to create Virginia’s advisor-sold program, CollegeAmerica®, available nationwide.

Virginia529 and its programs are consistently regarded highly by both experts and families.

Increasing Growth

CollegeAmerica® surpasses $10 billion in assets and Virginia Prepaid Education Program (VPEP) reaches its first billion.

Tax Benefits Made Permanent

Tax-free distributions established in 2001 become permanent in tax code.

Leading the Industry

CollegeAmerica® continues to grow, reaching $25 billion in assets, and Virginia Education Savings Trust (VEST) tops the $1 billion mark.

State Tax Deduction Doubled

Virginia General Assembly doubles annual state income tax deduction for 529 account contributions to a maximum $4,000 per account.

CollegeWealth Commences

Virginia529 launches, with partner Union Bank & Trust, a new saving option offering an FDIC-insured bank account.

CollegeWealth Expands

Virginia529 adds a new banking partner, BB&T, to expand CollegeWealth nationwide.

529 Day Begins

Virginia529 initiates a campaign celebrating May 29 as 529 Day and creates partnerships with Virginia hospitals to award accounts to select babies born that day.

The School Play

Some parents get a painful lesson about higher education planning. And others? They’re already saving with Virginia529.

SOAR Virginia® Scholarship Program Launches

SOAR Virginia inspires and assists high school students in reaching their post-secondary education goals. Participating students at eligible schools receive a range of assistance and earn scholarship support of up to $2,000 to apply toward their higher education expenses.

Read moreMom, Dad… We Need to Talk

Kids take an active role in preparing for their future higher education expenses in this commercial Virginia529 began running in 2010.

Virginia Prepaid Education Program (VPEP) name changes to Virginia529 prePAIDSM and Virginia Education Savings Trust (VEST) becomes Virginia529 inVESTSM. In addition, prePAID begins offering semester contracts to cut in half the cost of getting started.

Tuition Monster joins Virginia529

Tuition Monster joins the Virginia529 team in November 2012 after staff find him pestering new parents in a local hospital’s obstetrics department. We put him to work reminding parents of the importance of saving for college. Tuition Monster can be annoying at times, but he is easy to tame when you save with Virginia529.

Read more

Virginia529 introduces an email newsletter to share program news, special offers and saving tips with customers and prospective customers.

Read more

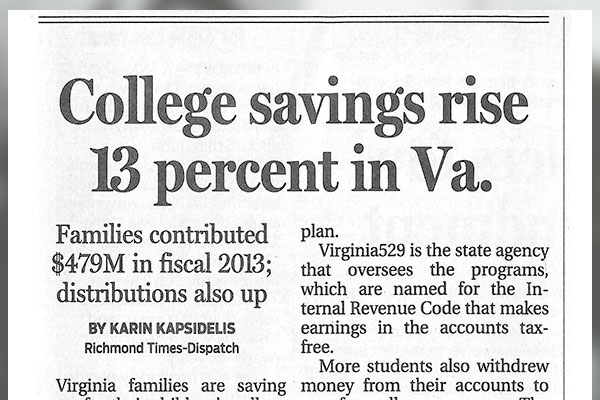

$50 Billion in Savings

Total assets invested with Virginia529 surpass $50 billion. With continued success, the agency looks for ways to make programs more competitive and attractive to current and prospective customers. As a result, Virginia529 decreases inVEST and CollegeAmerica® fees and eliminates the $25 application fee for new accounts opened online.

Added Benefits for Virginia529 Customers

The introduction of the Smart Savers Club rewards Virginia529 customers for saving.

Read more

Credit: AutismSpeaks.org

Following passage of the Stephen Beck, Jr. Achieving a Better Life Experience (ABLE) Act by Congress in December 2014, the Virginia General Assembly authorizes Virginia529 to create a disability savings program. The program will be called ABLEnow.

ABLEnow Gears Up

Virginia529 opens ABLEnow, the Virginia-sponsored state ABLE program, to help individuals with disabilities save money for present and future expenses like never before.

Read more

Two Decades of Helping People Prepare for the Future

Virginia529 celebrated twenty years of helping millions of families nationwide save for their academic savings goals.

Enter to Win

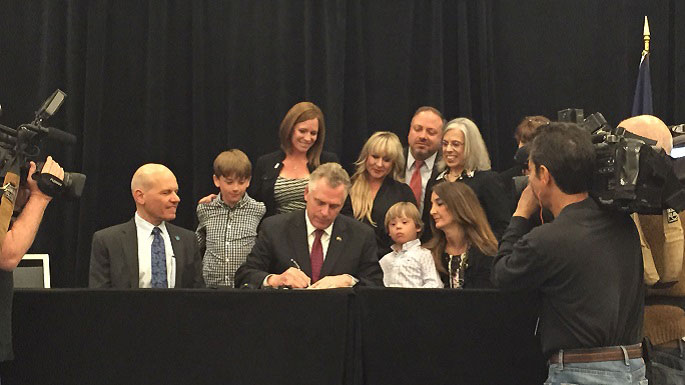

Governor Terry McAuliffe recognizes 2016 as the 20th anniversary of Virginia529

Read the proclamation (pdf)

Virginia529 and Capital Group launch ABLEAmerica, the first advisor-sold ABLE plan to help individuals with disabilities save for present and future expenses.

Read more

SECURE ACT expands qualified 529 expenses to include apprenticeships, student loan repayment and other uses.

Read more

State-facilitated Private Retirement Study

During the 2020 Virginia General Assembly legislative session, Virginia529 was tasked by lawmakers to study the interest in and feasibility of offering a new program that encourages individuals to save for this important life goal.

Read more